Due to the ability of fixed-income instruments to produce fixed and recurring income, bond investors are primarily focused on their coupon payments while they investigate the credit ratings, finalize their investment time-horizon and decide their risk tolerance level.

So, looking at inflation or rising price levels for goods and services in the United States, fixed-income instruments are more prone to inflation risk and will negatively impact the fixed nature of bond returns. This could eventually reduce the purchasing power of their fixed coupons.

In this article, we will take a closer look at how inflation puts a negative pressure on fixed-income investments including municipal debt.

Check out the different ways to invest in muni bonds to stay up to date with the current investment strategies.

How Inflation Impacts Your Fixed-Income Returns

In simple terms, inflation is a detriment to the purchasing power per unit of currency. The same goes for your bond coupon returns; for example, if you purchased a bond in 2015 with 5% coupon payments, which is also known as a nominal return, and the inflation was around 2%, your inflation-adjusted return on this instrument would be 3%. However, where the coupon is a fixed return, the inflation is the variable in this equation and an increase in inflation can reduce your inflation-adjusted return. Over time, this can take a major bite out of your portfolio returns. The same concept applies to the returns on your other investment vehicles like certificate of deposits or even savings accounts.

In the next section, we will take a closer look at how rising inflation can be directly attributed to an increase in market interest rates. If there is an expectation of rising inflation over a period of time, it may prompt investors to sell their fixed-income holding and possibly look for other vehicles paying higher coupons to keep up with the rising inflation levels. Going even further, the rising inflation expectations can also prompt equity investors to sell their holdings with the expectation that bond yields may present more lucrative opportunities than their equity holdings.

Be sure to check out this article where we discuss the impact of rate hikes on munis.

Impact of Interest Rate Fluctuations

In the rising inflation environment, the United States Federal Reserve is likely to raise the short-term interest rates to limit the availability of credit and protect the economy from overheating and limit the economic expansion.

- Bond values: As most investors are aware, interest rates and bond values are inversely correlated, which means when interest rates are on the rise, bond values decline, and when interest rates fall, bond values appreciate accordingly. In the secondary market, if a bond is selling at par ($1,000) with a 3% coupon it means that the market interest rates are similar to the bond’s coupon. However, if the interest rates increase, the same debt instrument will be selling at a discount in the secondary market, because, the primary market debt instruments, with similar maturities and credit, will now be issued at a higher coupon than the existing debt. The same concept applies in the declining interest rate environment – the existing debt becomes more lucrative than the new debt, which will now be issued at a lower coupon.

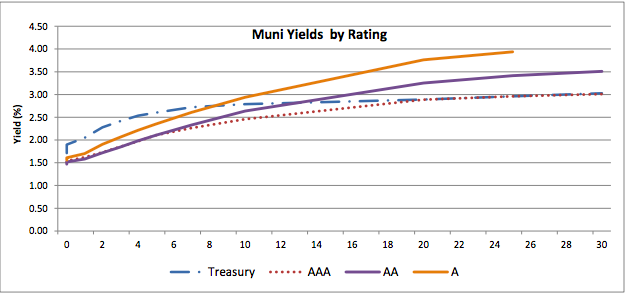

- Yield curve and yield to maturity (YTM): Yield to maturity represents the total return on a bond instrument, which reflects your coupon payments and your initial principal. For instance, if an investor buys a bond in the secondary market at a discount (less than its face value) and holds it until maturity, then your total return on the bond could be more than its coupon payments. This means that when interest rates go up, it impacts the YTM and you tend to see variations in the normal yield-curve shapes. As short-term rates increase, the curve flattens because longer maturities are more sensitive to the interest rate risk compared to shorter maturities. Along the same lines, the curve tends to get steeper when interest rates decline. As mentioned above, the enhanced YTM in the rising interest rate environment can also be a lucrative investment for stock/equity investors, in which they can potentially invest in discounted bonds and enhance their total return to more than just the coupon payments. In addition, the muni-Treasury ratio, which compares the relationship between AAA muni debt to Treasuries, has been improving due to the decline in supply for municipal debt instruments, and this ratio is projected to trend upward in the upcoming quarters. As shown below, the yield on municipal debt with longer maturities is trending above the yield on Treasuries.

- Preservation of principal: For some investors, the fear of rising inflation or interest rate changes is non-existent due to their risk tolerance and time horizon for their holdings. Many fixed-income investors purchase their debt holding with the hope of holding it until maturity. Now, if they purchased a bond at par ($1,000 or face value) and are willing/able to hold it until maturity and simply collect the coupon, they don’t need to worry about the rising or declining interest rates; they will be able to let the bond mature at its face value. However, the inflation-adjusted returns will continue to decline as inflation goes up. Along the same lines, the majority of fixed-income investors in the local government debt are also primarily looking for principal protection and enjoy the triple-tax exemption on their investment income.

Be sure to read our previous article where we showed investors’ strategies to protect against inflation.You can also use our tool here to discover muni bonds offering attractive yields.

The Bottom Line

The decline in purchasing power due to inflation is existent in any and all forms of investments. However, its impacts are felt more in fixed-income-investment instruments. Investors should certainly craft some investment strategies that can provide some hedge against the losses in investment income due to inflation.