Everything from corporate debt to municipal debt instruments, the sheer size of U.S. capital markets can certainly be puzzling for an investor seeking to strike the right balance between risk tolerance, time horizon and desired yield to enhance their potential returns.

In the global debt universe, government bonds make up the largest piece of the pie followed by the corporate debt instruments. Where both, corporate and municipal debt, are quite similar in their formation and structure, their returns and tax treatments can be significantly different for investors.

In this article, we will take a closer look at both forms of debt, their main characteristics and how each one can fit into an investor’s portfolio.

Check out the different ways to invest in muni bonds to stay up to date with the current investment strategies.

Understanding the Differences Between Municipal Debt and Corporate Debt

The municipal debt markets are comprised of a wide array of issuers and their respective debt instruments, which are often unique in terms of bond ratings, debt structures, and yields. These debt instruments are obligations of the states or local governments (county, city or schools) and make up the entire municipal bond market; furthermore, every local or state government have access to these markets to raise money for public purposes, such as water and sewer systems, building highways, schools and many other public buildings. Municipal debt instruments are commonly known for their interest income to be exempt from federal income taxes; in most states, interest income generated from municipal bonds is also exempt from state and local taxes.

Make sure to use our Municipal Bond Screener when looking for your next potential investment. You can also discover bonds offering attractive yields using our tool recent bond trades.

The issuance and structure of corporate debt is quite similar to municipal debt. The corporate debt markets are comprised of various issuers, the companies, which issue their debt to fund various projects. Similar to a municipality and its issuance, a company determines how much it would like to borrow and then issues a bond offering in that amount; at this point, investors that buy a bond are lending money to the company according to the terms written in the bond documents. Along the same lines, the company is also obliged to follow the bond offering documents to make periodic payment to its bondholders.

Despite the similarities, both instruments, municipal and corporate, have their own distinct characteristics that may align with an investor’s profile and his/her investment objectives. Let’s take a look at some of those differing characteristics:

1. Risk

Historically, the municipal debt or any investment instrument backed by the tax authority of a local government was once considered one of safest investment vehicles and very low on the risk spectrum until the well-known bankruptcies of U.S. municipalities including Detroit and Stockton. Although, these local government bankruptcies was a rude awakening for many investors and rating agencies, municipal debt instrument given their structure, issuer (local government) and tax revenue backing is still regarding as a safer investment than its corporate counterparts. The historical trends and analysis, conducted and reported by Moody’s Investor Service (Moody’s) and Standard and Poor (S&P), show that corporate debt defaults, with the comparable rating municipal debt, have been substantially higher than municipal defaults. According to Moody’s analysis, there have been only 71 municipal defaults from 1970 to 2011, compared to 1,784 corporate defaults during the same time period.

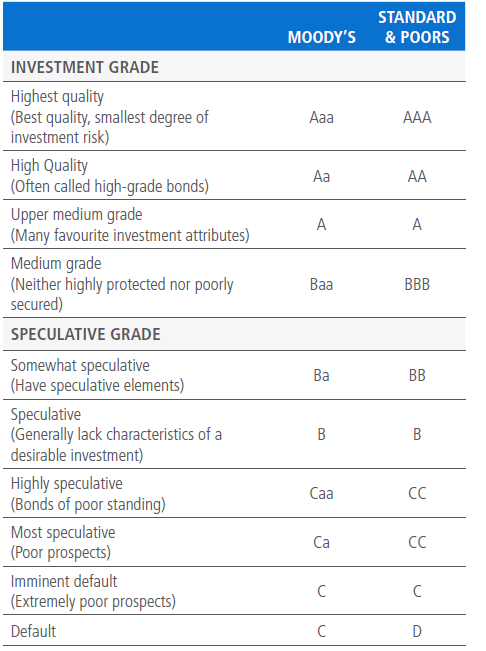

Furthermore, risk is assessed on two broad credit classifications: investment grade and speculative-grade bonds. The primary difference between the two classifications is that speculative-grade issuers are perceived to have a lower credit quality compared to more highly rates issuers that fall into investment grade. Shown in the table below are ratings often seen on various debt instruments.

2. Tax Status

The interest earned on most muni bonds is exempt from federal taxes and, in some cases, state taxes as well. The interest earned from corporate bonds is subject to taxation at both the federal and state level. This means that if you are an owner of municipal bond with a 5% coupon and you are looking to compare that return with a comparable rated corporate bond, you must calculate the tax-equivalent yield of your municipal security. The tax-equivalent yield takes into account an individual investor’s current tax rate to determine whether an investment in a municipal bond is equivalent to a corresponding investment in a given corporate bond. Let’s take an example: If you are in a 30% tax bracket and you are trying to decide between two investment vehicles: a municipal bond paying 5% coupon and a corporate bond paying 6.5%; which one presents a lucrative investment choice?

As mentioned earlier, the municipal bond income is exempt from federal taxes; so, your take-home return is 5%. However, on the corporate bond, you have to deduct the taxes from its return to calculate your actual return. In this case, it’s easily calculated by withholding 30% (tax rate) from the corporate return: 6.5% * (1-.30) = 4.55%.

This relation shows that even if the corporate bond is paying higher coupon, it’s tax-free yield (or take-home yield in this case) is still less than a municipal debt. Hence, the municipal debt presents more lucrative opportunity.

3. Returns

Given the tax-exempt status and safety, the average yield on municipal bonds is often significantly lower than corporate bonds; this assumes the comparable credit rating on both instruments. The municipal debt tends to be the safer option, which provides capital preservation and generates tax-free income; where a corporate bond typically generates high returns with potentially higher risk.

4. Liquidity

Liquidity is a measure of market demand and supply of a particular security in their respective markets. If an investor is able to sell his/her security with ease and with minimum transaction cost, that means the market for that particular security is relatively liquid and vice versa.

In the case of municipal and corporate debt, munis are generally less liquid than their corporate counterparts with comparable ratings. This is due to the relatively high daily trading volume of corporate debt than municipal bonds. Hence, the municipal debt holder may pay a price for their investment’s premature sale or accessing the market for their purchase compared to corporate bonds.

The Bottom Line

As an investor, you must carefully analyze your own investor profile before deciding on either municipal or corporate debt investments. If you’re looking for highly rated corporate bonds, there may not be much from which to pick; corporate debt typically lies on the relatively lower side of the ratings scale, and only a small number of corporate issuers hold ratings in the top two tiers.

Similarly, municipal bond investors looking for lower-rated investment-grade bonds and the higher yields may not be able to find much. Hence, an optimal investment portfolio will entail both offerings and an optimal mix that aligns with the investor profile.

Be sure to check out our News section to keep track of the recent municipal performances.

Sign up for our free 14-Day Premium Subscription to get full access to all tools and data on municipal bonds.

Disclaimer: The opinions and statements expressed in this article are for informational purposes only and are not intended to provide investment advice or guidance in any way and do not represent a solicitation to buy, sell or hold any of the securities mentioned. Opinions and statements expressed reflect only the view or judgment of the author(s) at the time of publication and are subject to change without notice. Information has been derived from sources deemed to be reliable, the reliability of which is not guaranteed. Readers are encouraged to obtain official statements and other disclosure documents on their own and/or to consult with their own investment professionals and advisors prior to making any investment decisions.