With the Fed’s continuous fight against inflation, the interest rate environment has been quite attractive for new municipal debt investments.

Investors are capitalizing on high coupon offerings with the hope that when rates start to come down, their current investment may yield additional income in the form of capital gains.

In the third quarter of this year, we have witnessed several key factors behind the municipal debt performance. First, municipal bonds are likely to benefit from consistent coupon payments and reinvestment funds, as well as a slower rate of new bond issuances. While there will be more new bonds introduced compared to the first half of the year, it likely won’t outweigh the impact of reinvestment funds. However, the combination of higher borrowing costs and substantial reserves means that borrowing needs are expected to remain restrained in the near future.

In this article, we will take a closer look at some positive trends we are seeing in fixed income markets and potential opportunities for municipal debt investors.

Inflation and Municipal Debt Demand

Last year (2022) was characterized by unprecedented outflows from municipal debt investments due to lower municipal debt coupons and other investment classes showing more attractive returns. However, in Nuveen’s quarterly update on municipal debt, the fiscal landscape of 2023 has exhibited a more sanguine trajectory, marked by net inflows amounting to $555 million up until May.

Looking ahead, it’s expected that the momentum of net inflows will hold strong, propelled by the abatement of concerns surrounding inflation dynamics and the Federal Reserve’s monetary policy stance. Investors are poised to reassess their positions regarding municipal bonds as an asset class endowed with a strong foundation, capable of delivering income against a backdrop of robust fundamentals.

Second, inflation is showing signs of returning to normal levels, which should create a more stable environment for investors. As we gain more clarity about the Federal Reserve’s plans to raise interest rates, investors are turning their attention to the positive incline of the municipal yield curve. As aforementioned, this curve trend offers an opportunity to extend portfolio duration, generating additional income for investors.

It’s important to note that the federal infrastructure renewal push, paired with local governments kickstarting their dormant capital investment plans, will likely add to more issuers entering the capital markets.

Municipal Default Risk Remains Low

When reviewing the municipal health and major revenue sources, the default risk is relatively low, hence fostering strengthening credit quality. However, with slower growth of the national economy, tax revenues for state and local governments will also grow more slowly. It is worth noting this moderation in tax revenue growth is not anticipated to instigate an escalation in defaults or credit rating downgrades; however, the momentum of credit rating upgrades is projected to decelerate in the future.

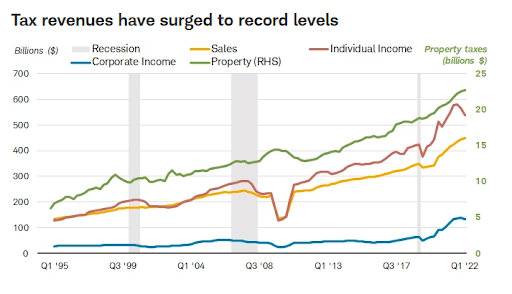

This deceleration in tax revenues is currently in the process of materializing, notably in states with higher reliance on revenue streams inherently intertwined with economic expansion like job growth, inflation, consumer spending, etc. A prime example was large metropolitan jurisdictions that witnessed a large outflow of the workforce during COVID-19, due to work from home or other reasons, which resulted in cracks in their tax base. The chart below shows a positive trend in revenue growth, along with a deceleration in individual and corporate incomes, for many municipalities throughout the United States.

Source: U.S. Census Bureau, as of Q1 2023

Macroeconomic Concerns

In the realm of finance, it’s comparable to the gold standard: AAA, a trio of letters signifying the utmost security in investments. For decades, the United States had proudly maintained this prestigious debt rating, a reflection of its role as the globe’s largest and most secure economy, a nation that had never faltered in meeting its debt obligations. However, the landscape has shifted. Recently, Fitch Ratings opted to lower the U.S. debt rating by a single level, transitioning from AAA to AA+. This adjustment was, in part, a reaction to the federal government’s handling of a debt crisis that unfolded just two months prior. This action echoed a similar downgrade enacted by S&P back in 2011, an event also triggered by a deadlock over the debt ceiling within the halls of Congress.

Fitch’s decision was driven by concerns ignited by the nation’s deteriorating financial outlook. The agency cast a spotlight on mounting apprehensions about the government’s ability to grapple with the ever-expanding weight of debt. These concerns stem from the deep-seated political schisms that have manifested in recent times. It’s too early to see how this may impact the municipal debt markets as a whole for investors.

The Bottom Line

In current market conditions, investors are paying close attention to three key areas:

- Issuers are maintaining strong fiscal positions proven by the reaffirmation of their credit ratings by rating agencies.

- Higher borrowing costs are translating into higher coupons for investors.

- Credit fundamentals remain strong due to historic revenue collections for many local governments.

In addition, strong reserves make municipal bonds well positioned to weather an economic slowdown driven by higher interest rates.