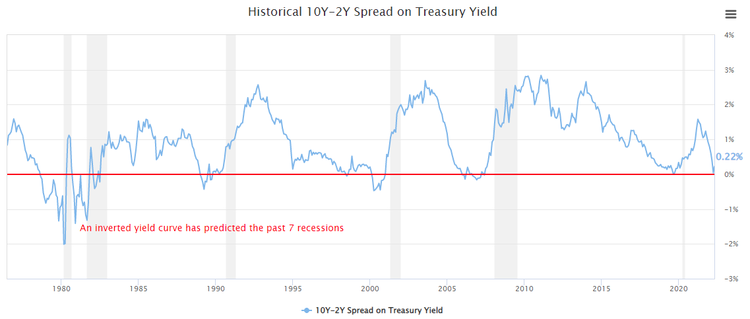

In the last few weeks, many investors were alarmed by the “inverted yield curve,” as for some, it indicates a financial recession being imminent in the near future. The yield curve movements and its inversion are two of the closely tracked phenomena by many fixed income investors.

The dynamic nature of the yield curve typically showcases how certain market forces and political decision making are impacting capital markets, and more importantly, the economy in general. From normal yield curve to flattened shape and then to some form of inversion are all indicative of the financial market conditions at a particular time – and, since it illustrates time/maturity related to the interest rates, investors watch the yield curve shapes very closely.

In this article, we will take a closer look at the different shapes of the yield curve and what the current yield curve indicate.

Be sure to check our Municipal Bonds Channel to stay up to date with the latest trends in municipal financing.

What Influences the Yield Curve?

As aforementioned, yield curve is a graph that reflects the yield of U.S. Treasuries, including bills, notes & bonds, starting from the shortest to the longest maturity over time. The y-axis of the yield curve reflects the interest rates you would expect to get on a debt instrument, while the x-axis shows the time to maturity for investments. For the yield curve to be called “normal,” you would expect higher yield on the longer-term maturities, given the relative interest rate risk, compared to shorter maturities. The yield curve is used as an important tool to gauge the economic direction of the domestic economy and how different forces are affecting investor sentiment. This is also an important tool for the Federal Reserve to craft their monetary policies to either expand or contract economic growth of the domestic economy to control things like inflation.

There are many factors that can impact the yield curve shapes – but primarily, the federal government’s actions and outlook will determine where the rates should be headed – whether that’s accomplished through their quantitative easing or quantitative tightening. In any event, if the Fed is thinking that we need to revive the economy after some form of a financial downturn, it will likely cut interest rates, which will bring down the rates for things like consumer borrowing and low relative returns for deposits/investments. The same is true for an economic outlook where inflation and economic expansion needs taming. The Fed would look to increase rates to bring stability and then try warding off a scenario for a possible economic downturn. For example, in an environment of low inflation and slow economic growth, investors are generally risk-averse and typically seek safety in the form of fixed income instruments, which puts a downward pressure on yields. On the other hand, an environment of relatively higher inflation and economic growth puts an upward pressure on yields.

Looking at the current economic conditions, the rising inflation in the U.S. has been a hot topic in the domestic financial news for a few months now. The recent March data shows that U.S. inflation surged to new heights in March 2022 to be around 8.5%, primarily driven by energy and food prices. This, paired with the existing supply constraints, isn’t helping issues.

Hence, the recent verdict from Jerome Powell, Chair of the U.S. Federal Reserve, entailed seeing up to five interest rate hikes to tame the inflationary pressures. The Fed fund rate and its movements – which entail the aforementioned five rate hikes – is what banks charge each other for overnight borrowing. This also sets the benchmark for things like consumer borrowing, including mortgages. The Fed fund rate is currently set at a target range of 0.75% to 1%, after two rounds of hikes this year – a 0.25% hike in March followed by a 0.5% hike in earlier this month.

Check out the differences between treasury and muni bond yield curves here.

Review of the Yield Curve Shapes

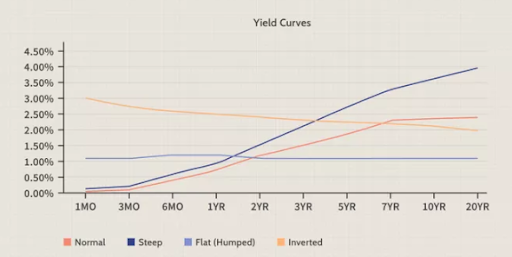

There are various yield curve shapes that highlight current financial conditions and investors use them to gauge the outlook for the economy: Normal Yield Curve, Flat Yield Curve and Inverted Yield Curve.

As the names suggest, these shapes directly correlate with the Treasury yields at different maturities on the curve. For example: for a flat yield curve, you would expect the shorter- and longer-term maturities to have relatively similar yields, which could indicate rapidly rising short-term interest rates, often controlled by the Fed with its quantitative tightening. Furthermore, this could indicate an economic expansion that the Fed is trying to control, including high inflation.

Normal Yield Curve: As shown in the image above, the red normal yield curve represents a “healthy” relationship between short- and long-term interest rates, indicating that the longer maturities are garnering higher yields than the short-term maturities. This is a common phenomenon, in which the longer you invest your funds, the higher the rates you should be expect. The same concept applies to shorter maturities garnering lower rates.

Flat Yield Curve: Shown in light blue, a flat yield curve indicates the same relative yields for maturities across the board, which tends to indicate a “not-so-normal” environment. As aforementioned, in a normal environment, investors should expect to get higher returns with respect to longer maturities. However, in a flat yield curve environment, the rates would be the same irrespective of timing.

Inverted Yield Curve: It’s often argued that an inverted yield curve is indicative of an upcoming recession and there is research to show that all yield curve inversions, especially an inversion of 2- and 10-year yield spreads, have been followed by an economic downturn. In an inverted yield curve, investors would see higher short-term rates and lower yields for longer maturities. Hence, the chart below shows the track record of yield curve inversion and how it successfully predicted the financial downturn in the U.S.

Don’t forget to check our Muni Bond Screener.

The Bottom Line

The dynamic nature of a yield curve can tell us a lot, including providing insight into the financial market’s outlook, the Fed’s stance and other helpful economic indicators. The current high inflation, as one of the leading economic indicators, is viewed as a detriment to the post COVID-19 economic growth, and, as such, the Fed is tackling the issue with aggressive rate hikes. Investors should keep a close eye on the shape of the yield curve, as market conditions continue to evolve.

Sign up for our free newsletter to get the latest news on municipal bonds delivered to your inbox.