MunicipalBonds.com provides information regarding the performance of muni bonds for the past week in comparison with Treasury yields and net fund flows, as well as the impact of monetary policies and relevant economic news.

- Short-term yields all up this week, while longer-term maturities fell.

- Muni bond funds saw its fourth week of inflows.

- Be sure to review our previous week’s report to track the changing market conditions.

GDP Surpasses Expectations

- The Consumer Confidence Index reported lower than expected at 127.7 versus the consensus of 131.0. Consumers are most likely worried about the volatility in the stock market but the measure still remains very high and a sign that the economy is strong.

- GDP numbers were released this week and the real GDP saw a quarter-over-quarter change of 2.9%, higher than the 2.7% consensus. Real consumer spending also saw a large increase, with a quarter-over-quarter change of 4.0%.

- The Bloomberg Consumer Comfort Index remained unchanged at 56.8. Even though the stock market has been tumultuous, this year’s tax-cut boost and continuing strength in the labor market continue to make consumers feel comfort.

- Jobless claims saw a decrease of 12,000 this week to a total of 215,000, which was lower than the consensus amount of 227,000. The four-week average, at 224,500. is also hovering around record-low levels.

- The Fed’s assets decreased by $9.0 billion this week, bringing the total asset base to around $4.392 trillion. This level is down $68 billion from the beginning of the balance sheet unwinding in October 2017.

- During the week, money supply (M2) decreased by $13.7 billion, a reversal of last week’s $9.5 billion increase.

Keep track of economic indicators that may impact the muni market.

Short-Term Yields Increase While Long-Terms Fall

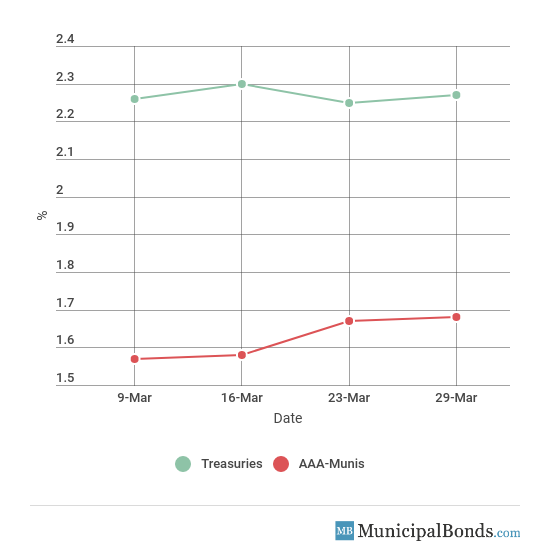

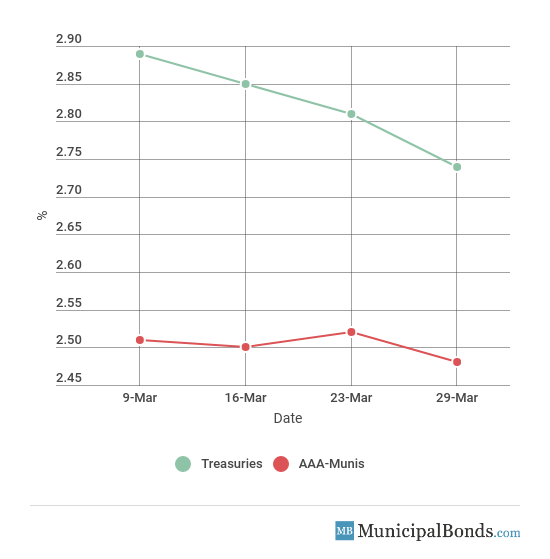

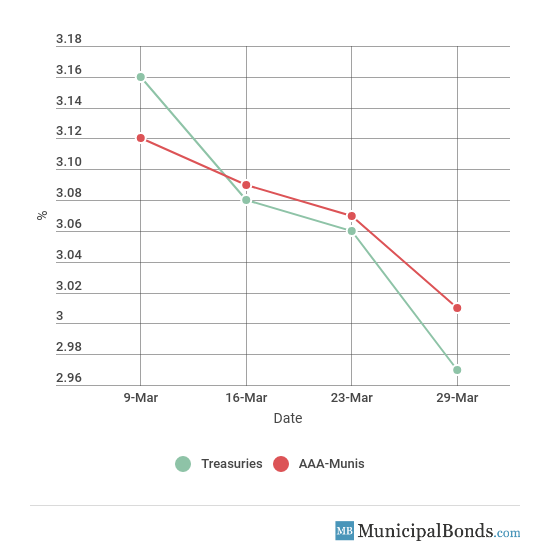

- Treasury yields were all down this week, with the exception of the 2-year Treasury, which increased by 2 bps to 2.27%. The 10-year Treasury saw a decline of 7 bps and now yields 2.74%, while the 30-year Treasury yield decreased by 9 bps and now yields 2.97%. Municipal yields also dropped this week, with the exception of the 2-year AAA-rated bond, which saw a gain of 1 bps to yield 1.68%. The 10-year AAA-rated bond decreased by 4 bps to yield 2.48%, while the 30-year AAA-rated bond yields decreased by 6 bps to yield 3.01%.

- Credit spreads increased this week, with the largest spread between the 2-year Treasury and the AAA-rated municipal bond now standing at 59 bps. Meanwhile, the spread between the 30-year securities increased to 4 bps.

Be sure to check our Market Activity section to keep track of daily muni trades and historical trades of muni CUSIPs across the U.S.

2-Year Yield Movement

10-Year Yield Movement

30-Year Yield Movement

Credit Spread

| Maturity | Treasury Yield | Muni Yield | Spread (in BPS) |

|---|---|---|---|

2-year | 2.27% | 1.68% | 59 |

5-year | 2.56% | 2.07% | 49 |

10-year | 2.74% | 2.48% | 26 |

30-year | 2.97% | 3.01% | -4 |

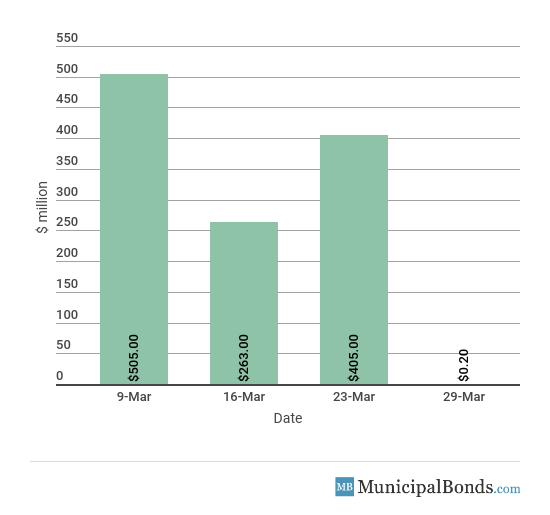

Muni Bond Funds Sees Fourth Week of Inflows

After witnessing $405 million of inflows last week, muni bonds saw its fourth week of inflows with an increase of $200,000 in assets under management.

Miami-Dade County Educational Facilities Authority Issues Revenue Bonds

The largest issue of the week comes from the Miami-Dade County Educational Facilities Authority, which issued $250 million Series 2018 revenue bonds this week. The issue is broken down into two issues, the Series 2018A, which consists of over $232 million, and the Series 2018B, which consists of over $17 million in bonds. The bonds are designed to help fund the Student Housing Village project for the University of Miami. The bonds are rated A3 by Moody’s and A- by S&P.

Rating Decision Updates on Muni Bonds

Upgrade

Moody’s Upgrades Medical College of Wisconsin to Aa3; Outlook Stable: Moody’s upgraded the Medical College of Wisconsin this week to Aa3 from A1, which was issued by the Wisconsin Health and Educational Facilities Authority. The Medical College of Wisconsin has made significant progressions toward growing its reserves over the last five years.

Downgrade

Moody’s Downgrades Macon-Bibb Consolidated Gov’t, GA’s GO debt to A1: Macon-Bibb County Consolidated Government of Georgia had its general obligation debt downgraded to A1 from Aa2. The area has had a tax base whose growth lagged over the last few years, leading to rising pension liability and debt obligations.

We provide this report on a weekly basis. To stay up to date with muni bond market events, return to our News page here.