MunicipalBonds.com provides information regarding the performance of muni bonds for the past week in comparison with Treasury yields and net fund flows, as well as the impact of monetary policies and relevant economic news.

- Shorter-term yields were mostly up this week, while longer-term maturities fell.

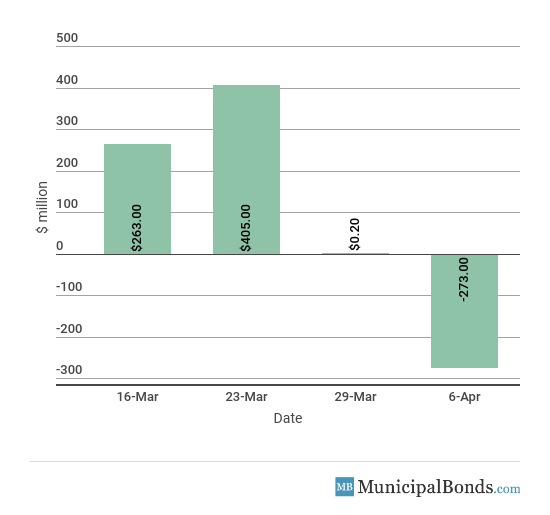

- Muni bond funds registered first week of outflows after four consecutive week of inflows.

- Be sure to review our previous week’s report to track the changing market conditions.

Unemployment Remains at 4.1%

- The employment situation was released on Friday and it came out lower than expected. Nonfarm payrolls saw a month over month increase of 103,000 versus the expected 175,000. Private payroll also didn’t meet expectations and saw an increase of 102,000 versus the expected 175,000. The unemployment level came in at 4.1% and higher than the consensus of 4.0%. Although the levels were higher than expectations, the levels are still near historic lows.

- The ADP Employment Report came in much higher than expected at 241,000 versus the consensus of 185,000. This high report further substantiates the strength of the labor market.

- The Fed President of San Francisco, John Williams, will be replacing the seat of New York Fed President, William Dudley, who is stepping down.

- The Bloomberg Consumer Comfort Index increased to 57.2 from 56.8. Consumers continue to show a level of comfort in the economy even though the stock market remains extremely volatile.

- Jobless claims saw an increase of 24,000 this week to a total of 242,000, which was higher than the consensus amount of 230,000. The four-week average, at 228,250, is still hovering around record-low levels.

- The Fed’s assets decreased by $6.1 billion this week, bringing the total asset base to around $4.386 trillion. This level is down $74 billion from the beginning of balance sheet unwinding in October 2017.

- During the week, money supply (M2) increased by $34.8 billion, a reversal of last week’s $13.8 billion decrease.

Keep track of economic indicators that might impact the muni market.

Treasury Yields Gain While Muni Yields Are Mixed

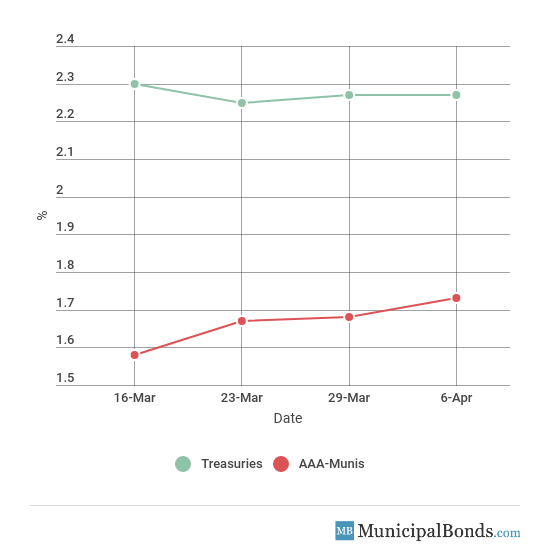

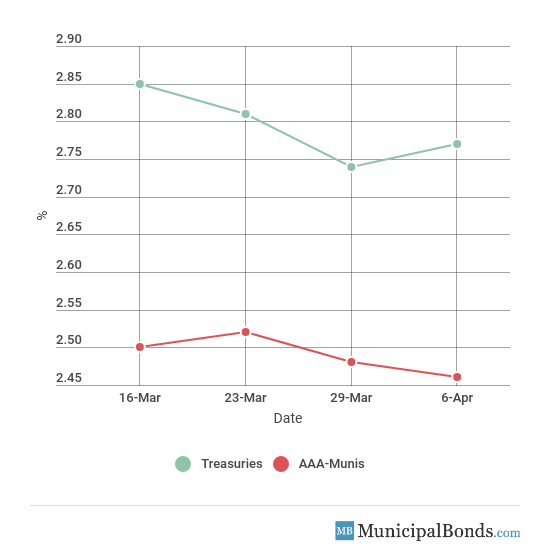

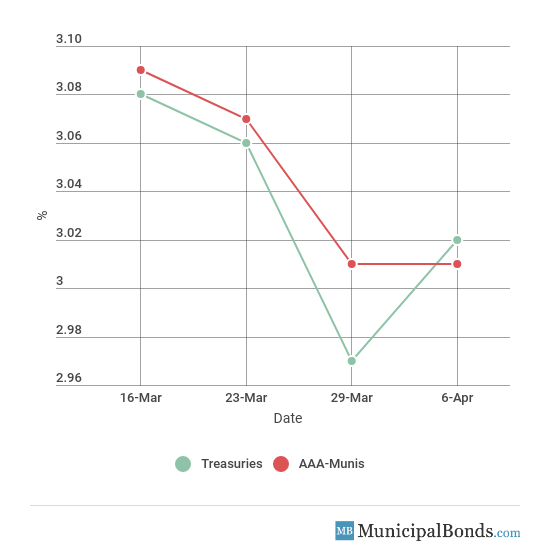

- Treasury yields were all up this week, with the exception of the 2-year Treasury, which saw no change and remains 2.27%. The 10-year Treasury saw an increase of 3 bps and now yields 2.77%, while the 30-year Treasury yield increased by 5 bps and now yields 3.02%. Municipal yields were a mixed bag this week with the 2-year AAA-rated bond gaining 5 bps to yield 1.73%. The 10-year AAA-rated bond decreased by 2 bps to yield 2.46%, while the 30-year AAA-rated bond yields remained unchanged to yield 3.01%.

- Credit spreads decreased this week, with the largest spread between the 2-year Treasury and the AAA-rated municipal bond now standing at 54 bps. Meanwhile, the spread between the 30-year securities decreased to 1 bps.

Be sure to check our Market Activity section to keep track of daily muni trades and historical trades of muni CUSIPs across the U.S.

2-Year Yield Movement

10-Year Yield Movement

30-Year Yield Movement

Credit Spread

| Maturity | Treasury Yield | Muni Yield | Spread (in BPS) |

|---|---|---|---|

2-year | 2.27% | 1.73% | 54 |

5-year | 2.59% | 2.10% | 49 |

10-year | 2.77% | 2.46% | 31 |

30-year | 3.02% | 3.01% | 1 |

Muni Bond Funds Back to Outflows

After seeing four weeks of consecutive inflows, muni bonds saw outflows of $273 million in assets under management this week.

The Oklahoma Development Finance Authority Issues Health System Revenue Bonds

The largest issue of the week comes from the Oklahoma Development Finance Authority, which issued over $1.162 billion in Health System revenue bonds. Series 2018B consists of over $911 million in bonds while the Series C consists of over $251 million in bonds that are taxable. The bonds will be loaned to OU Medicine, Inc., an Oklahoma not-for-profit corporation, for the purpose of acquiring, constructing, improving and equipping health facilities located in Oklahoma City and Edmond, Oklahoma. The bonds are rated Baa3 by Moody’s and BB+ by S&P.

Rating Decision Updates on Muni Bonds

Upgrade

Moody’s Upgrades Apex, NC to Aaa; Outlook Stable: Moody’s upgraded the Town of Apex in North Carolina’s general obligation debt to Aaa from Aa1. This affected $14.1 million in outstanding debt and the upgrade was caused by the town’s improving financial status and excellent management. The Aaa rating also applies to the town’s $23 million of General Obligation Public Improvement bonds, Series 2018 and the $1.16 million of general obligation refunding bonds.

Downgrade

Moody’s Downgrades Washington State University to Aa3; Outlook Stable: Washington State University had $585 million in outstanding debt downgraded to Aa3 from Aa2 this week. The university has a weakening financial status due to liquidity issues and increasing expenses. However, the school has begun implementing a plan to achieve fiscal balance by 2020.

We provide this report on a weekly basis. To stay up to date with muni bond market events, return to our News page.