MunicipalBonds.com provides information regarding the performance of muni bonds for the past week in comparison with Treasury yields and net fund flows, as well as the impact of monetary policies and relevant economic news.

- Treasury and municipal yields both saw increases this week.

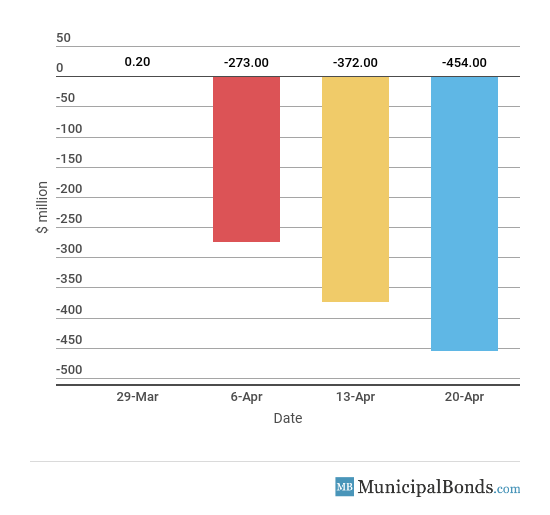

- Muni bond funds saw their third consecutive week of outflows this week.

- Be sure to review our previous week’s report to track the changing market conditions.

Outgoing NY Fed Chair Dudley Expects Rates to Hit 3%

- The new, soon-to-be Fed Chairman of New York, John Williams, spoke on Friday and announced that the Fed will most likely maintain its gradual pace of rate hikes in the future. He also mentioned that rates have been held low by three factors: an aging population, declining productivity and a high demand for cash.

- The outgoing New York Fed President, William Dudley, also spoke this week and feels that the threat of a trade war and the fiscal situation could pose potential challenges for the Federal Open Market Committee. He expects the Federal Funds Rate will be around the 3% range, which would equate to six more 0.25% rate hikes in the near future.

- Leading indicators matched expectations at 0.3%, which was a drop-off from last month’s 0.7% measure. This drop-off was undoubtedly from the volatility in the stock market, which has worried the average investor.

- The Bloomberg Consumer Comfort Index increased to 58.1 from 58.0. This is a continuation of a new high, which is the highest in 17 years, indicating the perceived confidence tied to the tax cut and strength in the jobs market.

- Jobless claims saw a decrease of 1,000 this week to a total of 232,000, which was slightly higher than the consensus amount of 230,000. The four-week average increased to 231,250 but is still hovering around record-low levels.

- The Fed’s assets increased by $2.2 billion this week, bringing the total asset base to around $4.386 trillion. The Fed has been reducing its balance sheet since September 2017 and will continue to do so until October 2018, at which time the decision will be reviewed.

- During the week, money supply (M2) decreased by $11.6 billion, a reversal of last week’s $4.1 billion increase.

Keep track of economic indicators that may impact the muni market.

Both Treasury and Municipal Yields Rise

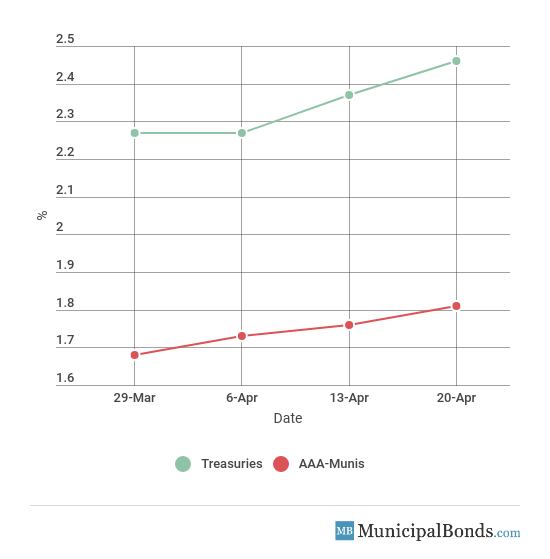

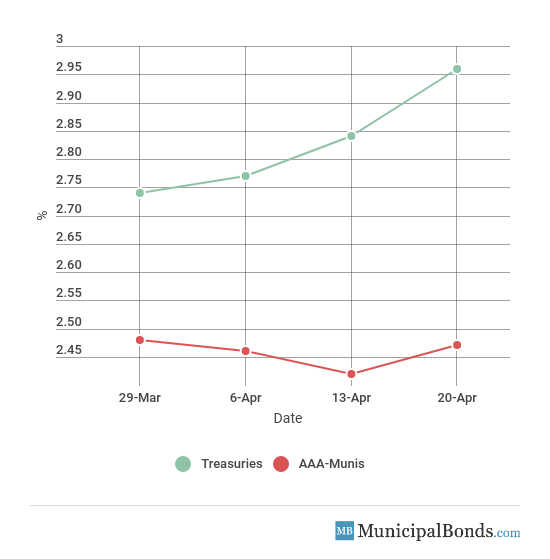

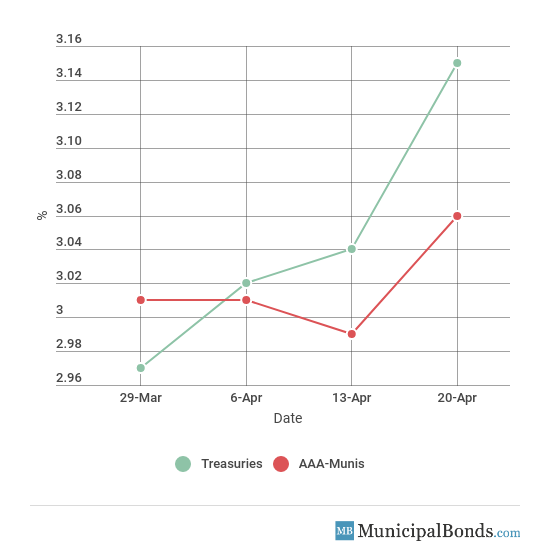

- Treasury yields all saw very large gains this week, with the 2-year Treasury gaining 9 bps to yield 2.46%. The 10-year Treasury saw an increase of 12 bps and now yields 2.96%, which is the highest level since 2011. The 30-year Treasury yield also increased by 11 bps and now yields 3.15%. Municipal yields were also up this week with the 2-year AAA-rated bond gaining 5 bps to yield 1.81%. The 10-year AAA-rated bond increased by 5 bps to yield 2.47%, while the 30-year AAA-rated bond gained 7 bps to yield 3.06%.

- Credit spreads increased this week, with the largest spread between the 5-year Treasury and the AAA-rated municipal bond now standing at 66 bps. Meanwhile, the spread between the 30-year securities increased to 9 bps.

Be sure to check our Market Activity section to keep track of daily muni trades and historical trades of muni CUSIPs across the U.S.

2-Year Yield Movement

10-Year Yield Movement

30-Year Yield Movement

Credit Spread

| Maturity | Treasury Yield | Muni Yield | Spread (in BPS) |

|---|---|---|---|

2-year | 2.46% | 1.81% | 65 |

5-year | 2.80% | 2.14% | 66 |

10-year | 2.96% | 2.47% | 49 |

30-year | 3.15% | 3.06% | 9 |

Muni Bond Funds See Outflow Trend

Muni bonds saw their third week in a row of outflows, with assets declining by $454 million.

The City of New York Issues General Obligation Bonds (NY)

The largest issue of the week comes from the City of New York, which had over $1.1 billion general obligation bonds. There are three subseries of the bonds, with the largest in the tax-exempt Subseries F-1, which made up $850 million of the issue. The rest of the bonds issued are taxable, in Subseries F-2, which makes up over $138 million and in Subseries F-3, which makes up over $111 million. The bonds are rated AA by S&P, AA by Fitch and Aa2 by Moody’s.

Rating Decision Updates on Muni Bonds

Upgrade

Moody’s Upgrades to Aa1 City of Conroe’s, TX GOLT: The city of Conroe in Texas had its limited tax obligations upgraded to Aa1 from Aa2. This affected over $163 million in bonds, as the upgrade was warranted due to the growth from the city’s rising income levels, reserves and liquidity.

Downgrade

Moody’s Downgrades Northview Public Schools, MI’s GO rating to A1: Moody’s downgraded the Northview Public Schools of Michigan this week to A1 from Aa3, affecting $45 million of its general obligation debt. The school system has seen significant declines in enrollment, paired with increasing expenses.

We provide this report on a weekly basis. To stay up to date with muni bond market events, return to our News page here.