MunicipalBonds.com provides information regarding the performance of muni bonds for the past week in comparison with Treasury yields and net fund flows, as well as the impact of monetary policies and relevant economic news.

- Treasury yields were mixed, while municipal yields all gained.

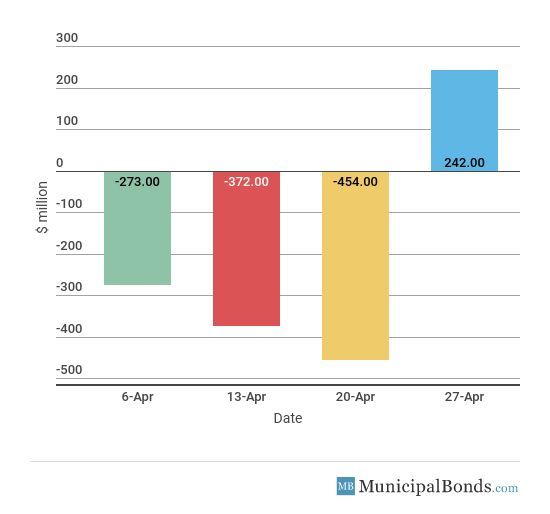

- Muni bond funds saw inflows, a reversal of three consecutive week of outflows.

- Be sure to review our previous week’s report to track the changing market conditions.

Strong Wages Data Suggests Fed Could Raise Rates Four Times

- GDP came in higher than expected at 2.3% versus the consensus of 2.0%, on a quarter-over-quarter basis. Residential investments, nonresidential investments and inventories were all positive, while net exports were negative. Consumer spending is up a moderate 1.1%.

- Employment Cost Index saw a quarter-over-quarter change of 0.8%, topping estimates of 0.7%. Total compensation, which includes wages and benefits, climbed 2.7% over the past year, strongest since the third quarter of 2008. This strong reading suggests the Fed may reconsider upping its interest rate hikes from three to four in 2018.

- International trade in goods came in better than expected in March at negative $68.0 billion versus the consensus of negative $74.5 billion, suggesting that the impact of the tariff on U.S. metal is not making an impact yet. Exports saw an increase of 2.5%, while imports saw a decline of 2.1%.

- The Bloomberg Consumer Comfort Index decreased to 57.5 from 58.1. Although this is lower than last week’s measure, it is still near all-time highs.

- Jobless claims saw a large decrease of 24,000 this week to a total of 209,000, which was much lower than the consensus amount of 230,000. This measure was the lowest level since 1969, indicating the strong job market is helping the economy. The four-week average decreased to 229,250 but is still hovering around record-low levels.

- The Fed’s assets decreased by $13.0 billion this week, bringing the total asset base to around $4.373 trillion. The Fed has been reducing its balance sheet since September 2017, and for 2018, the Fed’s Treasury holdings will be reduced by $270 billion, while holdings of mortgage-backed securities will be reduced by $180 billion.

- During the week, money supply (M2) increased by $10.0 billion, a reversal of last week’s $11.6 billion decrease.

Keep track of economic indicators that may impact the muni market.

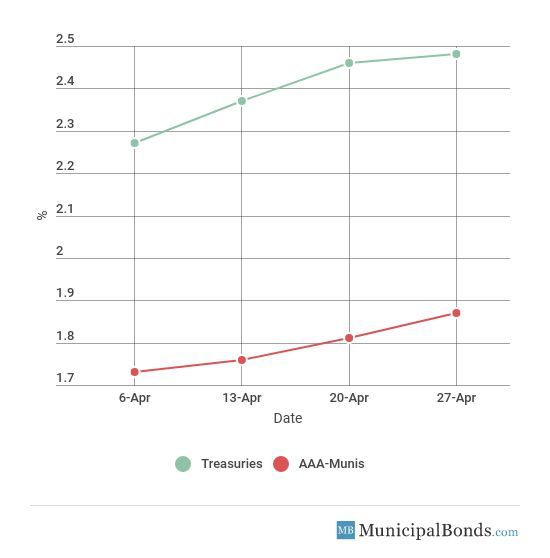

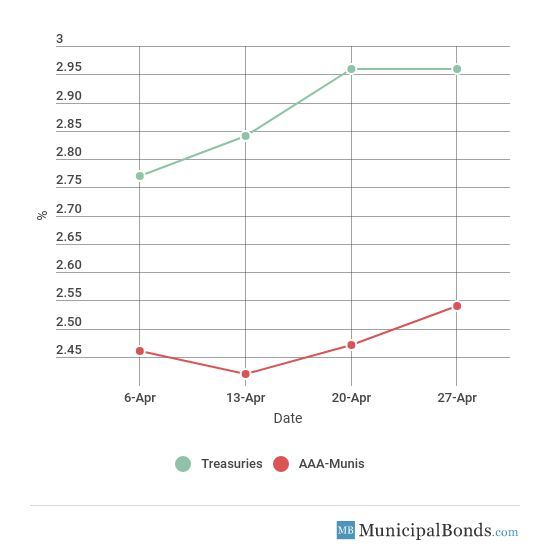

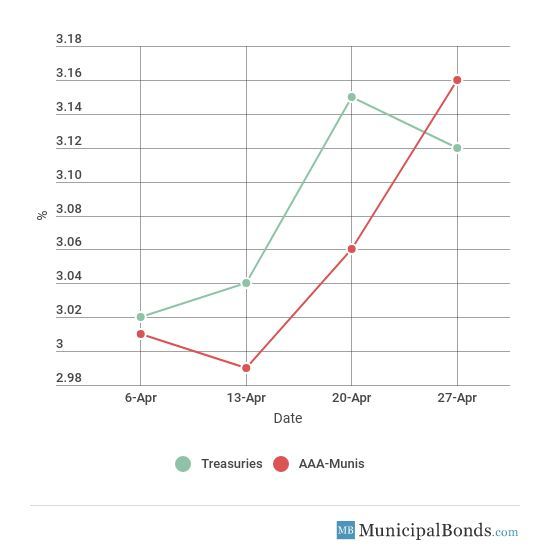

Both Treasury and Municipal Yields Rise

- Treasury yields were mixed this week, with the 2-year Treasury gaining 2 bps to yield 2.48%. The 10-year Treasury saw no change and remains at 2.96%. The 30-year Treasury yield decreased by 3 bps and now yields 3.12%. Municipal yields were all up this week with the 2-year AAA-rated bond gaining 6 bps to yield 1.87%. The 10-year AAA-rated bond increased by 7 bps to yield 2.54%, while the 30-year AAA-rated bond gained 10 bps to yield 3.16%.

- Credit spreads decreased this week, with the largest spread between the 2-year Treasury and the AAA-rated municipal bond now standing at 61 bps. Meanwhile, the spread between the 30-year securities decreased to 4 bps.

Be sure to check our newly launched Municipal Bond Screener to explore muni bond CUSIPs across the U.S based on custom parameters including the issuing state, insurance status and a range for different bond attributes such as maturity, coupon, price and yield.

2-Year Yield Movement

10-Year Yield Movement

30-Year Yield Movement

Credit Spread

| Maturity | Treasury Yield | Muni Yield | Spread (in BPS) |

|---|---|---|---|

2-year | 2.48% | 1.87% | 61 |

5-year | 2.80% | 2.21% | 59 |

10-year | 2.96% | 2.54% | 42 |

30-year | 3.12% | 3.16% | -4 |

Muni Bond Funds Back to Inflows

- Muni bonds reversed its trend and saw inflows of $242 million this week, after seeing three weeks in a row of outflows.

State of California Issues Federally Taxable General Obligation Various Purpose Bonds (CA)

The largest issue of the week comes from the State of California, which had over $2.147 billion of general obligation bonds. There are two subseries of the bonds, with the largest being $1.2 billion of various purpose general obligation refunding bonds. The other subseries consists of $947 million of various purpose general obligation bonds. Both bonds are federally taxable but tax-exempt from California State income tax. The bonds are rated AA- by S&P and Aa3 by Moody’s.

Rating Decision Updates on Muni Bonds

Upgrade

Moody’s Assigns Aa2 to Saugus Union SD’s SFID 2014-1 (CA) GO Bonds, Series B, affirms Aa2 GO ratings: Moody’s assigned the ratings of the School Facilities Improvement District (SFID) No. 2014-1 of the Saugus Union School District in California to Aa2. The affects $25.6 million of general obligation 2014 Election, Series B. At the same time, $16.2 million of the outstanding SFID general obligation bonds and $23.8 million of district-wide general obligation bonds. The area has seen significant upgrades to its revenue streams that help secure its general fund.

Downgrade

Moody’s Downgrades Wayne, MI’s Issuer Rating to B2; Outlook is Negative: Moody’s downgraded $22.1 million of the City of Wayne, Michigan’s, general obligation limited tax (GOLT) this week from B1 to B2. The area has an increasingly stressed financial position, due to a weak liquidity position and high leverage.

We provide this report on a weekly basis. To stay up to date with muni bond market events, return to our News page.