Puerto Rico’s decade-long fiscal decline, paired with financial mismanagement and natural disasters, led the commonwealth to file for bankruptcy protection to restructure its $129 billion debt portfolio comprised of public debt and unfunded liabilities.

The financial crisis of this U.S. commonwealth has contributed to a high poverty rate, in which 40% of Puerto Rican citizens are living under the poverty line and the unemployment rate has been above double digits, along with a nearly insolvent public healthcare system.

Puerto Rico’s bankruptcy process has been quite tumultuous, including contentious negotiations with creditors, bondholders, and public service employees. Furthermore, progress on this restructuring process and negotiation efforts were halted on Feb. 15, when the Federal Court of Appeals ruled the oversight board unconstitutional by stating that its board members are principal U.S. officers and should have been appointed by the U.S. president with the advice and consent of the Senate. The lawsuit to invalidate the oversight board and to ask for the dismissal of Puerto Rico’s bankruptcy case was brought forward by two of the major creditors of Puerto Rico: hedge fund Aurelius Investment LLC and bond insurer Assured Guaranty Corp. Where the court ruled in favor of these two creditors on the unconstitutionality of the oversight board, the appeals court rejected their litigation to dismiss the bankruptcy proceedings.

In this article, we will take a closer look at the current status of the restructuring process and what to expect.

Be sure to check out our Education section to learn more about municipal bonds.

The New Proposal From the Oversight Board

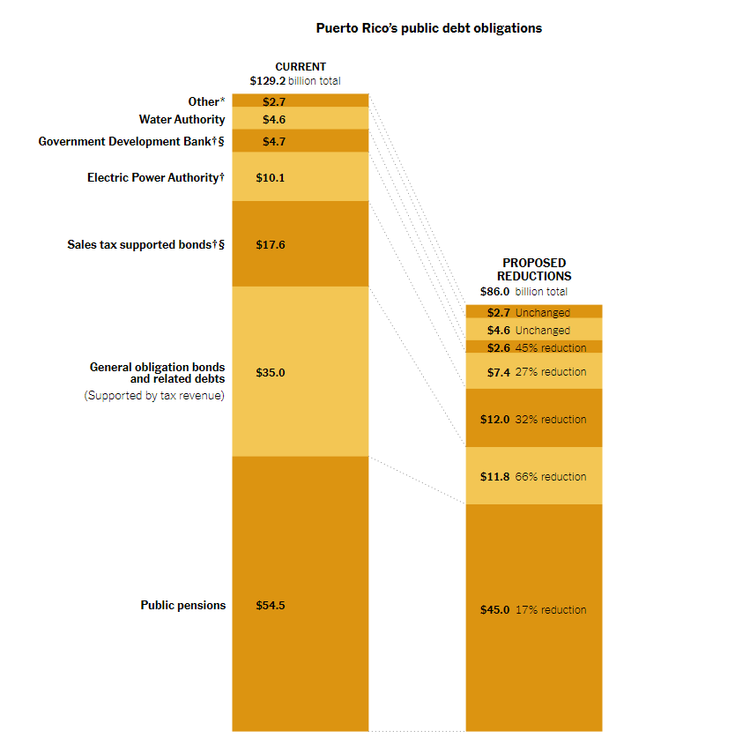

Recently, the Financial Oversight and Management Board introduced a plan to reduce the $129 billion in debts, comprised of public pensions ($54.5 billion approx), general obligation debts ($35 billion approx.), sales tax-backed debts ($17.6 billion approx.), electric authority ($10.1 billion approx.), governmental development bank, water authority and other debts, to about $86 billion – a 33% decrease. This plan will be presented to a federal judge who will decide on the validity of the plan, any disputes and, ultimately, make a decision on how to move forward.

The new proposition by the oversight board proposes huge cuts to certain debt obligations, while others will take a smaller loss. As shown in the picture above, and expected in a municipal bankruptcy, the general obligation debt is bound the take the biggest hit (66%), while revenue-backed debt is expected to be reduced by 32%. Although, revenue-backed debt – like sales tax-supported bonds – is typically insulated, there has been a contentious round of disagreements between GO and sales tax debt holders.

As reported in The New York Times, after seeing Puerto Rico’s pension obligations grow by more than any other debt, the agency, in 2013, decided to hire all new employees under a new defined contribution plan similar to a 401(k) plan. This move made a small dent into the mounting pension obligations, however, it was not enough and the government decided to move all current employees to the new plan. The new restricting plan introduces 17% in cuts to public pension obligations.

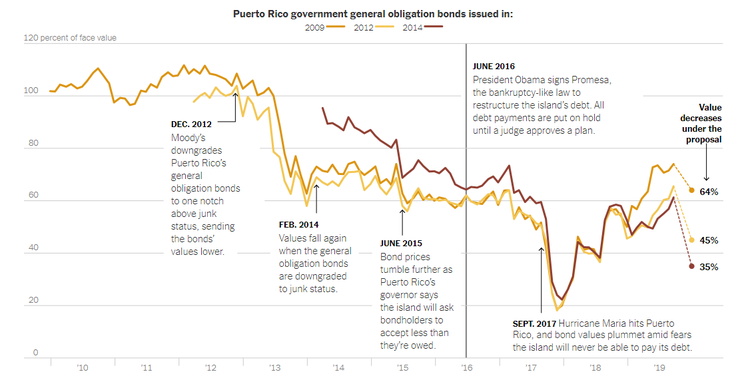

Furthermore, the plan also proposes to cut general obligation debt based on their issuance years. Based on the chart below, the general obligation debt issued in 2009 is taking a 36 percent loss under the new plan and other GO debts will see a loss in value as shown in the new plan.

Click here to learn more about the municipal debt due diligence process.

The Earlier Dispute Between Sales Tax Pledged Debt Holders and General Obligation

Throughout the financial restructuring of Puerto Rican debt, there has been an emergence of two primary disputes between GO and revenue-backed debt.

Many investors assume, rightfully so, that revenue-backed debt is a relatively safer investment option and consider its position to be higher than general obligation debt, due to the specific revenue streams that are typically collateralized to make the payment on these bonds. However, this assumption can be severely challenged in the event of local government insolvency or restructuring efforts.

This conundrum has caused quite a stir among Puerto Rico’s GO and COFINA debt holders. GO bondholders and their legal representatives brought forward lawsuits claiming that their debt obligations must be met by the island’s government before COFINA’s are paid, irrespective of any revenue pledges, liens or secured debt. There have been many references and interpretations made toward the GO debt structures, and the island’s Constitution states that GO debt must be paid before other expenses. The legal teams in favor of GO bonds have argued that the COFINA structure is invalid and violates the island’s Constitution, because Puerto Rico cannot continue to pay its sales tax bonds while skipping GO payments, especially when GO debt structure entails claim on any “available resources” of the commonwealth, including sales tax revenues.

On the other hand, COFINA debt holders filed their own lawsuits claiming that their debt indentures allow them to have the first claim on any revenues generated through sales tax, and that these revenues are not part of the general revenue to pay general debt obligations prior to revenue debt.

In addition, they have also claimed the invalidity of GO debt, since any GO debt issued after 2011 has been over the constitutional limit and, according to the lawsuit, should be rendered invalid. COFINA holders also say that since the sales tax revenue is specifically pledged for payment of revenue-backed debt, it doesn’t constitute “available resources” and cannot be mingled into the general fund.

The Bottom Line

The restructuring process for any type of government debt is a lengthy process that might cost hundreds of millions of dollars in consultant and attorney fees. The fiscal crisis in Puerto Rico, combined with the recent natural disasters, has created even bigger challenges for the commonwealth and its people. For the everyday municipal debt investor, Puerto Rico serves as a great example that highlights the intricacies of municipal debt markets and challenges the beliefs held by many investors about their investment holdings.

Sign up for our free newsletter to get the latest news on municipal bonds delivered to your inbox.

Disclaimer: The opinions and statements expressed in this article are for informational purposes only and are not intended to provide investment advice or guidance in any way and do not represent a solicitation to buy, sell or hold any of the securities mentioned. Opinions and statements expressed reflect only the view or judgement of the author(s) at the time of publication and are subject to change without notice. Information has been derived from sources deemed to be reliable, the reliability of which is not guaranteed. Readers are encouraged to obtain official statements and other disclosure documents on their own and/or to consult with their own investment professionals and advisers prior to making any investment decisions.